Simplified Capital Regime for Small Domestic Deposit Takers (SDDTs) - PS20/25

Introduction

The Prudential Regulation Authority (PRA) is introducing the Strong and Simple Framework for domestic-focussed banks and building societies that are non-systemic. The banks and building societies that meet the PRA’s eligibility criteria are classified as Small Domestic Deposit Takers (SDDT). This framework is fully consistent with the Basel Core Principles, but simpler than that applicable to larger and internationally active banks.

In December 2023, the PRA published Policy Statement 15/23 (The Strong and Simple Framework: Scope Criteria, Liquidity and Disclosure Requirements). This specified the SDDT eligibility criteria and prudential regulations for aspects not relating to capital requirements (e.g., liquidity and disclosures).

Subsequently, in September 2024, the PRA issued Consultation Paper 7/24 (The Strong and Simple Framework: The simplified capital regime for Small Domestic Deposit Takers (SDDTs)), outlining its proposed capital framework for SDDTs. Following consultation feedback, the PRA published near-final PS20/25 on 28 October 2025, confirming the near-final capital regime.

Together with the first phase of the Strong and Simple Framework, these rules establish a significantly simplified prudential regime for SDDTs, supporting a more dynamic, diverse, and competitive UK banking sector. The framework provides meaningful regulatory relief for smaller, domestically focused firms while maintaining resilience and financial stability.

Key Updates in PS20/25

Data Collection Exercise: The PRA has launched a data collection exercise for SDDTs, with a reference date of 31 December 2025 and a submission deadline of 31 March 2026.

Further Reporting Simplifications: The PRA has introduced further reporting adjustments for SDDTs, descoping them from an additional 13 templates — bringing the total number of capital-related templates de-scoped to 51. Some of these templates were already not applicable to many SDDTs, depending on their size and activities. The PRA has also made minor refinements, including removing rows and columns that are no longer relevant for SDDTs, to further simplify the remaining reportable templates.

ICAAP Frequency: In CP7/24, the PRA had proposed reducing ICAAP updates to every 2-years but retaining annual updates to Pillar 2A and 2B. In PS20/25, the PRA has now aligned both ICAAP and Pillar 2A/2B updates to every two years.

Implementing ICAAP and ILAAP Frequency Reductions: To ease the preparation burden for the 2026 ICAAP/ILAAP cycle, the PRA has decided that the rules and expectations on ICAAP and ILAAP frequency will take effect from the publication date of the final policy statement, which is expected in Q1 2026.

Operational Risk – Pillar 2A Assessment: In CP7/24, the PRA proposed a new bucketing approach linking operational risk capital requirements to firms’ total assets. In this PS, however, the PRA decided not to proceed with that approach and will retain the existing method of determining firm-specific add-ons through scenario analysis, supplemented by supervisory judgment.

Interim Capital Regime (ICR)

The PRA originally introduced the ICR as a temporary regime to bridge the implementation of Basel 3.1 and the simplified capital regime for SDDTs. However, following the decision to align both regimes with a common implementation date of 1 January 2027, the ICR is no longer required. As a result, the PRA will revoke the ICR framework — including related definitions and statements of policy — effective from the publication of the final policy statement (expected Q1 2026). Upon implementation, SDDTs will transition directly to the simplified capital regime, while non-SDDTs will move to the full Basel 3.1 standards.

Simplified Capital Regime

Pillar 1

The Pillar 1 capital requirements would be broadly aligned with the Basel 3.1 rules, as outlined in PS17/23 and PS9/24, to improve risk measurement and calculation of risk exposure amounts (REAs), making them more robust for both large and small firms. This consistent approach is intended to foster competition and promote the ongoing resilience of SDDTs.

Key Aspects of the Pillar 1 Proposals:

Basel 3.1 Standardised Approach: SDDTs will primarily calculate REAs using the Basel 3.1 standardised approaches for credit risk and operational risk. This approach offers a more accurate alignment between capital requirements and the actual risks associated with a bank’s assets, irrespective of the size of the institution.

Simplifications for SDDTs:

Notwithstanding the above, the simplified capital framework introduces several key simplifications for SDDTs:

Credit Risk Due Diligence: The Basel 3.1 due diligence requirements on credit ratings will not apply.

Exemption from Market Risk, Credit Valuation Adjustment (CVA) Risk and Counterparty Credit Risk (CCR): SDDTs will not be subject to capital requirements for market risk, CCR (for most derivative exposures) or CVA risk as the SDDT eligibility criteria require a firm to have minimal levels of market risk and trading activity, and as most SDDTs engaging in derivatives transactions will be doing so for risk management purposes.

Pillar 2A

The PRA has set out to simplify aspects of the Pillar 2A framework for SDDTs, enabling them to assess risks within their ICAAP in a more straightforward and proportionate manner, whilst maintaining resilience. As a result, the PRA has introduced a new Statement of Policy (SoP 5/25 - The PRA’s methodologies for setting Pillar 2 capital for Small Domestic Deposit Takers).

The existing Pillar 2A approach involves methodologies that can be unnecessarily complicated, particularly for smaller institutions with less complex risk profiles, in addition to opaque offsets or adjustments, such as the refined methodology and interactions with the countercyclical capital buffer (CCyB), making it burdensome for firms to compute and evaluate their Pillar 2A capital requirements.

The PRA has streamlined this process to improve clarity. The new framework introduces material simplifications to credit risk, credit concentration risk, and operational risk methodologies.

In addition to the changes to Pillar 2 methodologies, the PRA has launched a data collection exercise for SDDTs, with a reference date of 31 December 2025 and a submission deadline of 31 March 2026. The exercise aims to review banks’ Pillar 2 capital requirements and adjust own funds requirements and buffers, including the SME and infrastructure lending adjustments, to ensure these do not result in higher capital requirements.

Credit Risk

Key changes to the Pillar 2A credit risk assessment:

Removal of the Internal Ratings Based (IRB) benchmarking methodology as set out in the existing Pillar 2 SoP, thus eliminating the need to submit the FSA076 (Pillar 2 Credit risk standardised approach wholesale) and FSA077 (Pillar 2 Credit risk standardised approach retail) returns.

Apply credit scenarios that focus on high-severity tail events over a 12-month horizon, with a particular emphasis on how these events may result in credit losses for higher-risk lending that is not captured under Pillar 1.

Where an SDDT is a new or growing bank, or is predominantly engaged in unsecured retail lending or other bespoke or non-standard lending, the PRA expects the firm to conduct a focused assessment of its risk profile to determine whether a credit risk add-on under Pillar 2 is warranted.

Credit Concentration Risk (CCoR)

Simplifications in the Calculation of Credit Concentration Risk (CCoR) for SDDTs:

The PRA has replaced the Herfindahl-Hirschman Index (HHI) methodology with a simpler approach comprising a base add-on for CCoR, split into distinct components for retail and wholesale exposures. Under the revised approach, the wholesale add-on is set at 3.5% of relevant RWAs, and the retail add-on at 1%. As a result of removing the HHI methodology, the associated reporting requirements — FSA078 and FSA079 — have also been withdrawn.

In addition to the base add-on, the PRA will periodically assess single-name and sector concentration risks using data from the existing large exposure and stress testing frameworks, as described in the draft SDDT ICAAP Supervisory Statement.

In CP7/24, the PRA had proposed that during an SDDT’s C-SREP, it would assess single-name concentration by comparing the sum of its large exposures to Tier 1 capital, with engagement triggered if the total exceeded 300%. In this PS20/25, the PRA tightens this “cluster limit” threshold from 300% to 200%, while retaining the same methodology and intent.

In PS20/25, the PRA further clarifies that the following exposures are exempt from CCoR add-ons: (a) eligible covered bonds, and (b) defaulted exposures, irrespective of whether the latter are reported under the ‘exposures in default’, ‘exposures associated with particularly high risk’, or ‘subordinated debt, equity and other own funds instruments’ exposure classes.

The PRA plans to review its approach to CCoR for all firms as part of Phase 2 of the Pillar 2A review, which it currently expects to consult on in 2027. As part of this review, the PRA will take into account feedback on the SDDT CCoR methodology, including the treatment of SMEs, and consider whether further refinements are appropriate.

Operational Risk

As part of CP7/24, the PRA had proposed a new approach for calculating operational risk capital requirements for SDDTs, involving the introduction of a bucketing methodology based on firms’ risk profiles and linking capital requirements to total assets. In this policy statement, however, the PRA has decided not to proceed with the bucketing approach. Instead, it will retain the current practice of determining firm-specific add-ons through the firm’s scenario analysis, supplemented by supervisory judgment and an assessment of the firm’s risk profile.

Pillar 2A lending adjustments

As part of this PS, the PRA has also published SoP5/25, which sets out details of the SME and infrastructure lending adjustments, along with the related reporting templates and instructions. The PRA has also launched a data collection exercise, with a reference date of 31 December 2025 and a submission deadline of 31 March 2026, to determine the appropriate lending adjustments for Day 1 (i.e., on the implementation date).

Pillar 2B - Capital Buffer Framework

The PRA has introduced several significant changes to the capital buffer framework for SDDTs to enhance the simplicity and effectiveness of their own funds requirements:

Introduction of the Single Capital Buffer (SCB): The existing multiple capital buffers will be replaced by the SCB, which will be part of the Pillar 2B capital framework. The SCB is set at a minimum of 3.5% of RWAs, but may vary based on firm-specific stress outcomes and supervisory judgment.

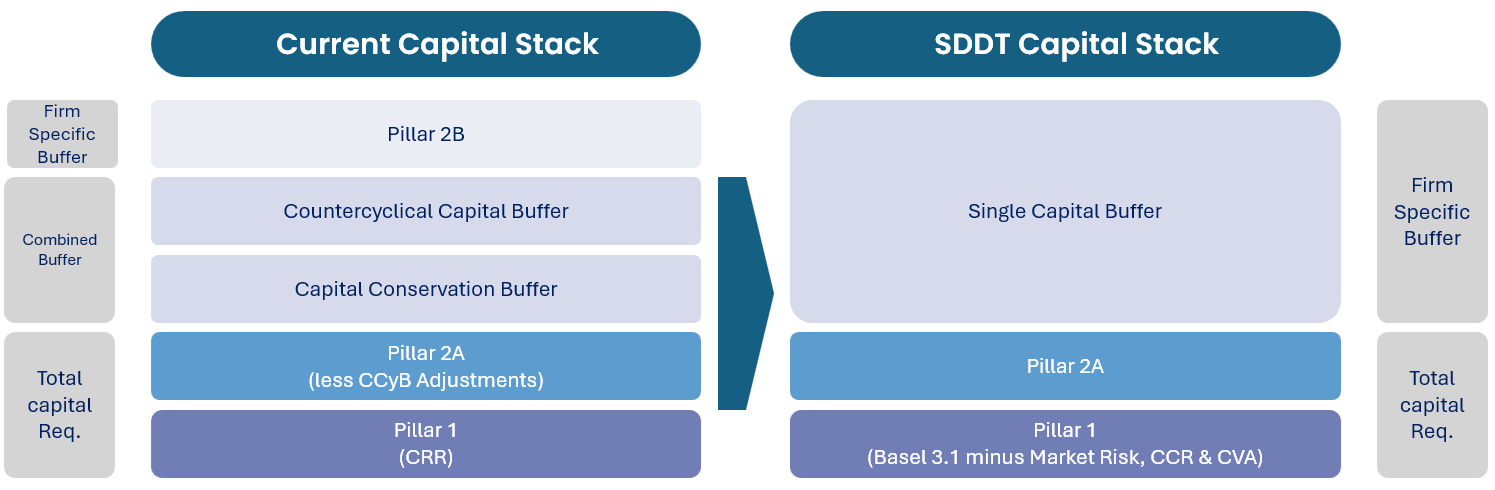

As a result of the changes in capital requirements, the capital stack will be updated as follows:

SDDT scenarios: The current cyclical stress testing framework will be replaced with ‘SDDT scenarios’. This new approach will establish a severity benchmark to aid SDDTs in developing their own stress scenarios as part of their ICAAPs, and is also intended to produce a relatively stable buffer requirement irrespective of financial cycles.

Methodology for New and Growing Banks: Similar to pre-existing frameworks, the specific methodology for calculating the SCB for new and growing banks will be based around 6-months of projected operating expenses, but must be no lower than 3.5% of RWAs as for other SDDTs.

Removal of Automatic Capital Conservation Measures: SDDTs will be de-scoped from the automatic capital conservation measures linked to certain buffers and part of the Maximum Distributable Amount (MDA) framework.

The Internal Capital Adequacy Assessment Process (ICAAP)

The PRA currently expects firms to conduct and update their ICAAP at least annually, with more frequent reviews following significant changes in business or operating conditions. However, recognising that many SDDTs have simple and stable business models, the PRA considers these requirements potentially burdensome and has therefore simplified expectations for such firms.

Document Frequency: The frequency of ICAAP updates for SDDTs from annually to every 2-years[1].

Referencing the ILAAP: SDDTs will be allowed to reference relevant sections of their ILAAP in their ICAAP documents to avoid unnecessary duplication, streamlining the process while ensuring liquidity risks are adequately addressed. This does not apply in the case that there are liquidity risk concerns, which must also be separately assessed in the ICAAP.

Reverse Stress Testing (RST): The frequency and documentation of RST will be reduced from annually to every 2-years. SDDTs can perform qualitative RSTs rather than full quantitative analyses, focusing on scenarios that could lead to failure without needing extensive numerical data. In this PS, the PRA clarifies that qualitative RSTs may include identifying risks, events, or scenarios that could render the firm unviable; assessing potential remedial actions; and identifying mitigants to prevent or reduce the impact of such risks.

New Optional Structure for ICAAP: The PRA introduces an optional example structure for ICAAP documents to guide SDDTs, which may be particularly useful for new banks. This structure suggests how to conduct risk assessments proportionately and indicates where to reference other documents, such as the ILAAP.

Despite these simplifications, SDDTs must ensure their ICAAP and ILAAP documents remain current and relevant. The PRA retains the discretion to request more frequent updates where necessary, particularly in cases of poor quality, weak governance, or material changes in the firm’s risk profile.

[1] To ensure alignment with the ICAAP, the required frequency of the ILAAP is also reduced from at least annually to at least every 2-years, but provisions remain that this should be done more frequently if needed.

Capital Deductions

Currently, banks must deduct specific items when calculating their regulatory capital resources. For instance, when determining the value of Common Equity Tier 1 (CET1) capital, firms need to subtract intangible assets, deferred tax assets (DTAs), and holdings of regulatory capital instruments from other financial institutions. These deductions are necessary because their value can be uncertain during stressful situations, which may reduce the amount of loss-absorbing capacity when it is most needed.

Some deductions from own funds are straightforward; however, for other items, deductions only apply above specific thresholds, making capital calculations more complex, which the PRA considers unduly onerous and disproportionate for SDDTs, which do not currently hold significant levels of such items.

As a result, the PRA had simplified the deduction requirements as follows:

Single Group for Deductions: All items subject to threshold calculations will be combined and treated as a Single Group. This includes:

DTAs dependent on future profitability, and

Holdings in regulatory capital instruments of financial sector entities (including CET1, Additional Tier 1, and Tier 2 instruments).

Single Threshold: The total value of the Single Group will be compared against a single threshold of 25% of the firm's CET1 capital.[2]

Deduction Amount: SDDTs must deduct from their CET1 capital any amount that exceeds the Single Threshold, with the deduction allocated proportionally amongst the respective items identified in the single group. Items below the Single Threshold will be risk-weighted at 250%. In PS20/25, the PRA introduced full capital deduction for qualifying holdings outside the financial sector, certain securitisation positions, and free deliveries, which further simplifies the calculations.

[2] PRA Rulebook: CRR Firms: SDDT Regime Instrument 2026: Article 45A 4(b) - the threshold amount is 25% of the CET1 items of the SDDT calculated after applying the adjustments and deductions in Articles 32 to 36 in full.

Reporting

The PRA has introduced changes aimed at streamlining reporting requirements for SDDTs and reflecting the various changes discussed above. These proposals focus on minimising unnecessary reporting, ensuring the PRA can still assess SDDTs’ risks, and simplifying the overall reporting framework.

Changes include de-scoping SDDTs from 51 reporting templates, replacing most Counterparty Credit Risk (CCR) reporting with a simplified template, and updating a further 24 templates and instructions (six of which are instruction-only changes). These revisions are designed to reduce the reporting burden while maintaining essential levels of information for oversight.

A summary of the key changes for SDDTs’ reporting is as follows:

Net Stable Funding Ratio (NSFR): SDDT firms that secure 50% or more of their funding via retail deposits are exempt from calculating and submitting the NSFR (this is replaced with the Retail Deposits Ratio (RDR)).

Pillar 2 Liquidity: The PRA generally does not expect to apply Pillar 2 liquidity guidance to SDDTs or require related returns (e.g., intra-day liquidity). However, firms must continue to assess liquidity risks not captured under Pillar 1 (LCR).

Capital Simplifications: Updates to the C01.00 template remove certain complexities, such as the introduction of a simplified capital deduction threshold. The introduction of a Single Capital Buffer also simplifies related reporting.

Templates Descoped: The following additional templates have been removed from scope: C05.01, C05.02, C11.00, C32.01–C32.04, C33.00S, LV40.00, LV41.00, LV43.00, and LV44.00.

Tailored Templates: The SC03.00 and SC14.01 templates have been tailored for SDDTs through the removal of additional rows and columns. The PRA has also deleted rows and columns that are no longer relevant to SDDTs, further simplifying the remaining reportable templates.

Counterparty Credit Risk: For SDDTs, counterparty credit risk reporting is replaced with a new template for most firms (SC34.00). Similarly, CVA reporting has been eliminated for SDDTs.

Market Risk Reporting: There is significant de-scoping in market risk reporting for SDDTs, with only templates SC22.00 and SC90.00 [3] being retained.

Pillar 2 Reporting: Simplifications include removing the requirement to submit Pillar 2 returns (FSA072 to FSA080) and updates to templates such as FSA071 and PRA111.

Template Labelling: New and tailored templates for SDDTs are labelled with an ‘S’ to indicate that they are SDDT-specific. For example, template “C01.00” has been renamed “SC01.00.”

[3] New template specified under PS9/24, OF90.00 MARKET RISK: AUTHORISATIONS, which relates to which market risk methodologies banks are applying, and to collect information on the relevant eligibility requirements for the derogations for small trading book business and the exemptions from the SA.

Overall Summary of SDDT Simplifications

| Item | Description |

|---|---|

| Phase 1 Simplifications PS15/23 Implemented on 1 January 2024 | |

| Definition of an SDDT | Implementation of the SDDT criteria, allowing firms to qualify and opt into the regime through a straightforward consent-based process. |

| Exemption of Net Stable Funding Ratio (NSFR) reporting |

Introduction of a simple Retail Deposit Ratio (RDR) to assess firms’ retail funding. SDDTs with stable and sufficient retail funding may be exempt from reporting the NSFR. The RDR is calculated as: RDR (%) = Total retail deposits / Total funding SDDTs can discontinue NSFR reporting if their 4-quarter moving average RDR remains at or above 50% for four consecutive quarters. |

| Pillar 2 methodology for liquidity add-ons | Pillar 2 liquidity add-ons will typically not apply to SDDTs, though supervisors may impose them for specific liquidity risks if significant idiosyncratic risks are identified. |

| A new ILAAP document template | A refined template designed specifically for SDDTs’ reporting, offering enhanced guidance on completing their ILAAP in a proportionate manner. |

| Descoping of select Additional Liquidity Monitoring Metrics (ALMM) Returns | SDDTs are exempt from reporting four out of the five ALMM returns. |

| Descoping from Pillar 3 disclosures for most SDDTs |

SDDTs with no listed securities are exempt from publicly disclosing Pillar 3 returns. SDDTs with listed securities are now only required to disclose quantitative information on key regulatory metrics, risk-weighted exposure amounts, and remuneration awarded, along with qualitative details on the firm’s remuneration policy. |

| Phase 2 Simplifications – PS20/25 | |

| Pillar 1 Framework |

A Pillar 1 framework for SDDTs is largely based on the Basel 3.1 rules, incorporating the following simplifications: – Standardised approach for credit risk, with an exemption from the requirement to perform due diligence on the use of external ratings. – Simplified market risk framework, including exemptions from capital requirement calculations and significant reductions in reporting templates. – Exemption from capital requirements for counterparty credit risk (CCR) on derivatives, which also impacts the Leverage Ratio and Large Exposures frameworks. – Exemption from capital requirements for credit valuation adjustment (CVA) risk. |

| Pillar 2A Framework |

– Simplified Pillar 2A methodologies for credit risk and credit concentration risk. – Removal of Pillar 2A methodologies and expectations for market risk and group risk, along with the elimination of complex adjustments related to the Countercyclical Capital Buffer (CCyB) for SDDTs. |

| A new capital buffer framework | A new firm-specific Single Capital Buffer (SCB) to replace the current capital buffer framework (which included the Capital Conservation Buffer (CCoB), the CCyB and PRA buffer). |

| Simplifications to the ICAAP & ILAAP |

– Reduction in the frequency of ICAAP & ILAAP updates from annually to every two years (other than new and growing banks), with added flexibility to cross-reference relevant sections. – Introduction of an optional ICAAP document structure that SDDTs may adopt. – ICAAP & ILAAP frequency changes effective from final policy publication, expected in Q1 2026. |

| Simplifications to capital deduction rules | Simplification of the calculation of capital deduction thresholds into a single threshold calculation. |

| Simplifications to reporting requirements | De-scoping of 51 reporting templates for SDDTs. |

How We Can Help

Banks may encounter a range of challenges connected to the Strong and Simple Framework: from evaluating their eligibility, to understanding the benefits and drawbacks of opting in, to making sense of the substantial changes arising across the prudential risk management framework, including the ICAAP and ILAAP, and evaluating the impacts on own funds and other prudential requirements, including regulatory reporting.

At Katalysys, we are experts in prudential risk management and regulatory reporting and specialise in working with small- and medium-sized banks who may fit into the category of an SDDT firm.

With a substantial level of analysis required and critical business decisions for banks approaching rapidly, our team is ready to assist you in ensuring that your bank is well-placed to make informed strategic decisions and navigate the changing landscape of prudential requirements in the UK.

For more information, please contact:

Josh Nowak

Managing Director, Risk & Regulatory Consulting

T: +44 (0)7587 720988

Manish Patidar

Director, Regulatory Consulting

T: +44 (0)7766 001643