Navigating the Solvent Exit Analysis: A Strategic Imperative for Small- and Medium-Sized Banks

Executive Summary

The introduction of the Solvent Exit Analysis (SEA) requirement by the Prudential Regulation Authority (PRA) marks a significant milestone in regulatory preparedness for UK banks. Effective from 1 October 2025, the regulation mandates that all non-systemic banks and building societies maintain a credible plan to wind down their regulated activities in a solvent and orderly manner, should recovery no longer be viable, or not an option altogether.

As a leading regulatory consultancy with deep expertise in the banking sector, and a strong market share among small and medium-sized firms, we are well positioned to guide banks through the complex requirements of the SEA.

In this article, we outline the core expectations of an SEA, draw out common challenges, and describes how we can help you transform a regulatory obligation into a strategic opportunity.

As the 1 October 2025 deadline approaches, banks must move swiftly to develop, review, and approve their SEA documents. Starting early is critical to allow for internal engagement, governance, and any required iterations of the document.

With guidance from our team, banks can build robust, proportionate, and fit-for-purpose SEA documents that also serve as strategic assets in a dynamic banking environment.

Introduction

In today’s rapidly evolving financial and regulatory environment, contingency planning has become a core component of effective risk management. The SEA provides banks with a structured framework to plan for an orderly withdrawal from regulated activities, should one be required, maintaining solvency throughout the process and safeguarding depositor and other stakeholder interests.

Unlike a Recovery Plan, which seeks to restore a firm’s financial health, or a Resolution Plan, which anticipates severe distress and ultimately failure, the SEA occupies a unique space. It addresses circumstances in which recovery is not feasible, yet insolvency is not (yet) inevitable. In this context, the SEA becomes a crucial tool in ensuring business continuity and minimising risk of any systemic disruption.

What is an SEA?

An SEA is a document that outlines how a bank would terminate its regulated activities while remaining solvent. It is designed to ensure that even in the absence of viable recovery options, a bank can conduct an orderly wind-down without breaching regulatory thresholds or placing customers and counterparties at undue risk.

Key objectives of the SEA include:

Articulating a range of plausible scenarios, including both stressed and strategic triggers, that might necessitate a solvent exit.

Detailing the operational and regulatory steps involved in winding down activities.

Estimating the financial and non-financial resources required to support an exit process.

Establishing a framework of indicators and thresholds that provide early warning and guide timely decision-making.

Providing a strong foundation for the development of a Solvent Exit Execution Plan (SEEP), should a solvent exit become likely.

The SEA is both a regulatory assessment document and a strategic resource, reinforcing resilience and readiness for adverse circumstances.

Core Components of an SEA?

Scenario Planning

Effective solvent exit planning begins with a robust analysis of potential exit scenarios. These may include strategic decisions to exit the market, a decline in business viability, the withdrawal of group support, or other forms of financial stress. Both stressed and non-stressed scenarios should be considered to ensure comprehensive coverage. Scenario planning not only helps to validate the feasibility of a solvent exit but also promotes alignment between business strategy and risk appetite.

Risk Identification and Barriers

An SEA must identify potential obstacles to an orderly exit. These might include illiquid or complex asset portfolios, untraceable customer deposits, reliance on outsourced services, or legal and contractual constraints. Proactively addressing these risks ensures a smoother execution in the event that an exit becomes necessary. The SEA document should also account for the time and effort involved in resolving such barriers.

Operational Execution

A detailed operational plan is central to a successful SEA. This plan should set out the sequence of activities required to complete the exit, from initial trigger identification to the final closure of regulated activities. Steps will vary from bank to bank, but are likely to include returning customer funds, disposing of or transferring assets, terminating contractual agreements, handling redundancy and retention of staff, decommissioning IT systems, and cancelling regulatory permissions.

Financial and Resource Planning

The SEA must present suitably-substantiated financial forecasts demonstrating the bank’s ability to remain solvent throughout the exit. These forecasts should include monthly projections of capital adequacy, liquidity resources, and profit and loss. In addition, non-financial resources must be evaluated. These include staffing requirements, legal, advisory and other specialist services, third-party supplier support, systems availability, and administrative capabilities. The analysis should also incorporate costs related to staff redundancies, contract terminations, and any required customer incentives.

Indicators and Triggers

A well-designed SEA includes a set of clearly defined metrics that serve as early warning indicators or triggers. These indicators should be calibrated to signal when the firm should begin preparing a SEEP, and also when to initiate the actual exit process. Indicators need to be adapted to the needs of the business, but might include declining profitability, deteriorating capital ratios, loss of critical funding sources, or reputational damage. Both qualitative and quantitative factors should be considered, and the thresholds must be aligned with the firm’s overall risk appetite as well as other related risk management documents, such as the ICAAP, ILAAP and Recovery Plan.

Governance and Accountability?

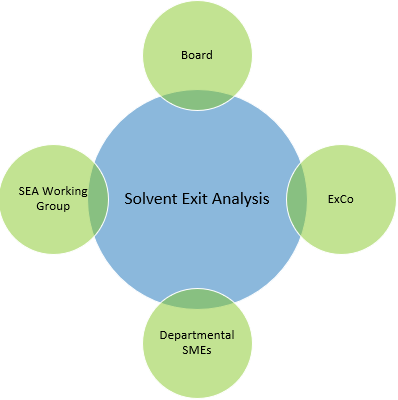

Strong governance is critical to the credibility and effectiveness of the SEA. Responsibility for overseeing the SEA typically lies with a senior executive, such as the Chief Risk Officer (CRO) or Chief Financial Officer (CFO). However, successful delivery of the SEA requires input from across the entire organisation.

A cross-functional working group, drawing on expertise from finance, risk, compliance, operations, HR, and legal, should be established to support the planning process. This working group should ensure timely contributions, co-ordinate documentation, and address challenges as they arise.

The final SEA must undergo thorough internal review and challenge, culminating in approval by the Board of Directors.

Common Challenges and Solutions

Implementing a SEA can present several challenges. One common issue is the difficulty in estimating asset disposal values or predicting exit costs. Firms should adopt conservative assumptions and refer to historical precedent or recovery planning exercises, for example, for guidance.

Another challenge is achieving effective cross-functional collaboration. This can be addressed by forming a dedicated SEA steering committee/ working group to oversee the process, with clear roles and responsibilities allocated.

Firms may also struggle with defining realistic timelines. To overcome this, a phased approach should be adopted, breaking down the exit into manageable steps and sequencing activities based on dependencies and any required external (including regulatory) interactions.

Strategic Benefits

While compliance is a key driver of the SEA, the process can also generate broader benefits for the firm. It enhances internal co-ordination, sharpens risk management practices, and provides the board with greater visibility into managing a complex business. The SEA also supports strategic flexibility by preparing the institution to exit unprofitable or non-core activities with minimal disruption. As such, it should be seen not just as a regulatory obligation but as a valuable planning tool.

Our Service Model

We offer a comprehensive and modular SEA service that can be tailored to each client’s needs. Our approach is grounded in regulatory expertise and a deep understanding of the operational realities of small- and medium-sized banks. We tailor our service to the needs and requirements of each client, but we typically include:

Facilitating structured workshops and engaging internal stakeholders.

Helping to define exit scenarios and key assumptions.

Building capital and liquidity forecasts using financial models.

Conducting gap assessments against the requirements of SS2/24.

Drafting and iterating the SEA document in collaboration with internal teams.

Supporting board and committee presentations.

Contact Us

Josh Nowak

Managing Director

Risk & Regulatory Consulting

T: +44 (0)7587 720988

E: josh.nowak@katalysys.com

Manish Patidar

Director

Regulatory Consulting

T: +44 (0)7766 001 643

E: manish.patidar@katalysys.com