Covid-19:Transitional arrangements for CET1 adjustment due to IFRS 9

Transitional arrangement

As part of the response to Covid-19 pandemic, the EU implemented a ‘quick fix’ (EU 2020/873) for the capital impact arising from expected credit losses (ECL) accounting under IFRS9. This enables the transitional arrangements to be extended by 2 years, and add back to the bank’s Common Equity Tier-1 (CET-1) capital any increase in new ECL provisions that is recognised in 2020 and 2021 for financial assets that are not credit impaired [Article 473a].

The amount that can be added back to CET-1 capital is calculated using this simplified formula:

AB = ( A[2] – t1 ) x f1 + ( A[4] - t2 ) x f2 + ( A[old] – t3 ) x f1

where (assuming the bank transitioned from IAS39 to IFRS9 on 01.01.2018)

A[2] = MAX {0; (IFRS9 provisions as of 01.01.2018) - (IAS39 provisions as of 01.01.2018)}

t1, t2, t3 = increase of Common Equity Tier 1 capital that is due to tax deductibility of the amounts A[2], A[4] and A[old] respectively;

f1 = applicable factor based on the period:-

0.7 from 1 January 2020 to 31 December 2020

0.5 from 1 January 2021 to 31 December 2021

0.25 from 1 January 2022 to 31 December 2022

0 from 1 January 2023 onwards

A[4] = MAX {0; (IFRS9 provisions as of ‘reporting date’) - (IFRS9 provisions as of 01.01.2020)};excluding life time ECL for financial assets that are credit impaired(i.e.Stage 3)

f2 = applicable factor based on the period:-

1 from 1 January 2020 to 31 December 2020

1 from 1 January 2021 to 31 December 2021

0.75 from 1 January 2022 to 31 December 2022

0.5 from 1 January 2023 to 31 December 2023

0.25 from 1 January 2024 to 31 December 2024

0 from 1 January 2025 onwards

A[old] = MAX {0; (IFRS9 provisions as of 01.01.2020) - (IFRS9 provisions as of 01.01.2018};excluding life time ECL for financial assets that are credit impaired (i.e. stage 3)

Definition of credit impaired financial assets [EU 2016/2067] – A financial asset is credit-impaired when one or more events that have a detrimental impact on the estimated future cash flows of that financial asset have occurred. Evidence that a financial asset is credit-impaired include observable data about the following events:

a) significant financial difficulty of the issuer or the borrower;

(b) a breach of contract, such as a default or past due event;

(c) the lender(s) of the borrower, for economic or contractual reasons relating to the borrower's financial difficulty, having granted to the borrower a concession(s) that the lender(s) would not otherwise consider;

(d) it is becoming probable that the borrower will enter bankruptcy or other financial reorganisation; (e) the disappearance of an active market for that financial asset because of financial difficulties; or

(f) the purchase or origination of a financial asset at a deep discount that reflects the incurred credit losses.

It may not be possible to identify a single discrete event—instead, the combined effect of several events may have caused financial assets to become credit-impaired.

Example

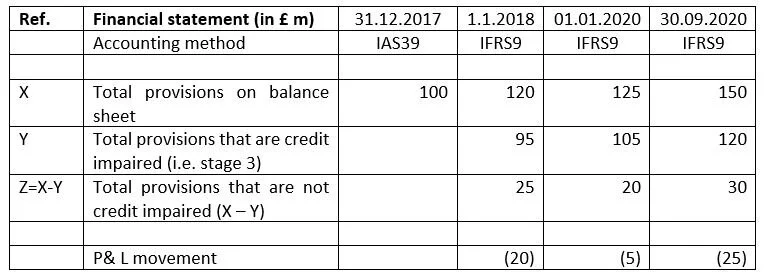

A simplified example of this calculation is shown based on the table below:-

Assumptions:-

The bank transitioned to IFRS9 on 01.01.2018

The reporting date for which this calculation is done is 30.09.2020

The bank had no increase in capital due to tax deductibility (i.e. t1, t2, t3 = 0)

Calculation of CET-1 transitional adjustment for IFRS9

The analysis of each component for this example will enable us to calculate the CET-1 add-on :-

AB = ( A[2] – t1 ) x f1 + ( A[4] - t2 ) x f2 + ( A[old] – t3 ) x f1

A[2] = MAX {0; (IFRS9 provisions as of 01.01.2018) - (IAS39 provisions as of 31.12.2017)}

A[2] = MAX {0; 120 – 100} = 20 (reference X above)

A[4] = MAX {0; (IFRS9 provisions as of 30.09.2020) - (IFRS9 provisions as of 01.01.2020};excluding credit impaired items

A[4] = MAX {0; 30 – 20} = 10 (reference Z above)

A[old] = MAX {0; (IFRS9 provisions as of 01.01.2020) - (IFRS9 provisions as of 01.01.2018};excluding credit impaired items

A[old] = MAX {0; 20 – 25} = 0 (reference Z above)

f1 = 0.7 (factor from list above)

f2 = 1 (factor from list above)

AB = ( A[2] – t1 ) x f1 + ( A[4] - t2 ) x f2 + ( A[old] – t3 ) x f1

AB = 20 x 0.7 + 10 x 1 + 0 x 0.7

AB = 24

Hence, the amount to be added back to CET-1 will be £24 million.

Implementation timeline: EU implemented a ‘quick fix’ on 24 June 2020 (EU 2020/873) and this transitional arrangement is applicable from 27th June 2020.