The 2025 ICAAP Scenarios — Stress Testing for Small- and Medium-sized Banks

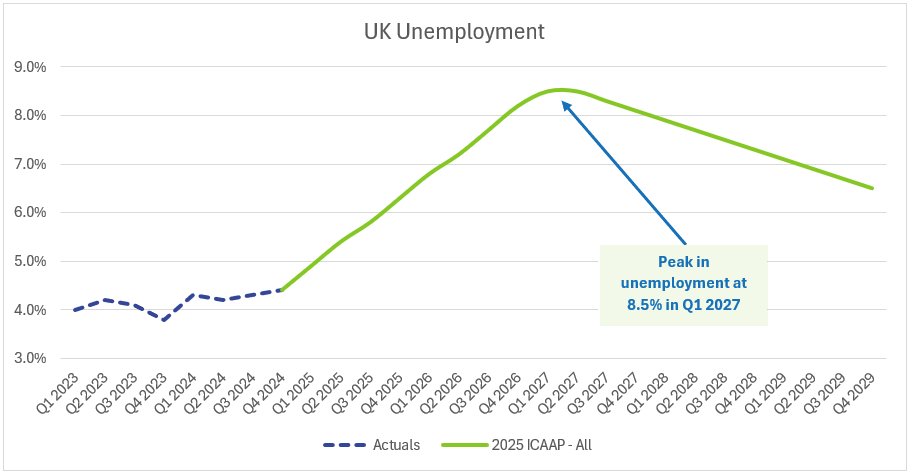

Arriving hot on the heels of our earlier article on what the 2025 Bank Capital Test Means for small- and medium-sized banks, the Prudential Regulation Authority (PRA) has published an accompanying set of stress parameters. These include both rates-up (supply shock) and rates-down (demand shock) scenarios, and can serve as a useful benchmark for firms not participating in concurrent stress testing. They may be particularly helpful for use in internal stress testing exercises, including within the Internal Capital Adequacy Assessment Process (ICAAP).

These latest ICAAP Scenarios are derived by the PRA from the 2025 Bank Capital Stress Test, published by the Bank of England on 24 March 2025.

As we noted back in early April, many banks were encountering challenges with the 2024 ICAAP scenarios, particularly when stress tests were set to begin from a different reference date, or when they covered a time horizon that used by the PRA. Firms also expressed concerns about how to treat divergences between observed macroeconomic conditions and the PRA’s stressed projections, in particular where the economic environment has been volatile, and also due to the passage of time.

The release of this updated set of ICAAP Scenarios will therefore be welcomed by banks with an eye on their next ICAAP.

Below, we provide a summary of selected parameters that are likely to be relevant for small- and medium-sized institutions. These parameters can be applied flexibly, whether a firm’s corporate planning period spans the more common 3-year horizon, or for banks looking at a longer horizon, including up to 5-years.

As always, firms should adapt the scenarios and parameters to their own business model and risk profile to ensure they are fit-for-purpose for their own stress testing exercises. This can be a challenging process, but is nevertheless an important one to maximise the relevance of the scenario testing process and promote informed decision-making and capital adequacy assessments.

How We Can Help

At Katalysys, we support banks in developing robust, proportionate, and forward-looking ICAAP and ILAAP frameworks, with a strong emphasis on meaningful stress testing.

Whether facilitating Board and management workshops, selecting scenarios tailored to a bank’s specific risk profile, or building bespoke capital and liquidity stress models, we work closely with clients to deliver clarity, credibility, and actionable insights.

We help firms respond to an evolving macroeconomic landscape by applying well-calibrated, relevant stress scenarios with a view on the current risk environment. Our team is focused on demystifying stress testing, ensuring that frameworks are both practical and well-structured, and which are aligned with regulatory expectations and best practices.

For more information, please contact:

Josh Nowak

Managing Director

Risk & Regulatory Consulting

T: +44 (0)7587 720 988

E: josh.nowak@katalysys.com

Ravi Patel

Vice President

Risk & Regulatory Consulting

T: +44 (0)7387 972 729

E: ravi.patel@katalysys.com